The modern world of business development is characterized by high levels of competition and rapidity of change, which makes it imperative to obtain the required capital to grow and become stable. Small business loans are favorable for many clients, especially business people and directors of small businesses as they can easily access the loans. This blog will help you understand how to get a personal loan for your business.

The Overview of Personal Loans for Business

A personal loan for business is an unsecured facility which can be utilized for any entrepreneurial activities. Compared to the typical small business loan that you have to offer your assets as security, the personal loans are issued depending on your credit score and your ability to repay the amount borrowed. This makes them suitable for people such as self-employed people or business owners with little assets.

Advantages of using Personal Loans for Business

1. Flexibility: There is flexibility on how the funds derived from personal loans can be used in business or purchasing of materials goods or working capital.

2. Faster Approval Process: Personal loans take less time to be processed and approved this means that if you need money for your business, you get it on time as compared to normal business loans.

3. No Collateral Requirement: Personal loans do not require any business security because they are unsecured, hence no need to use business property to guarantee.

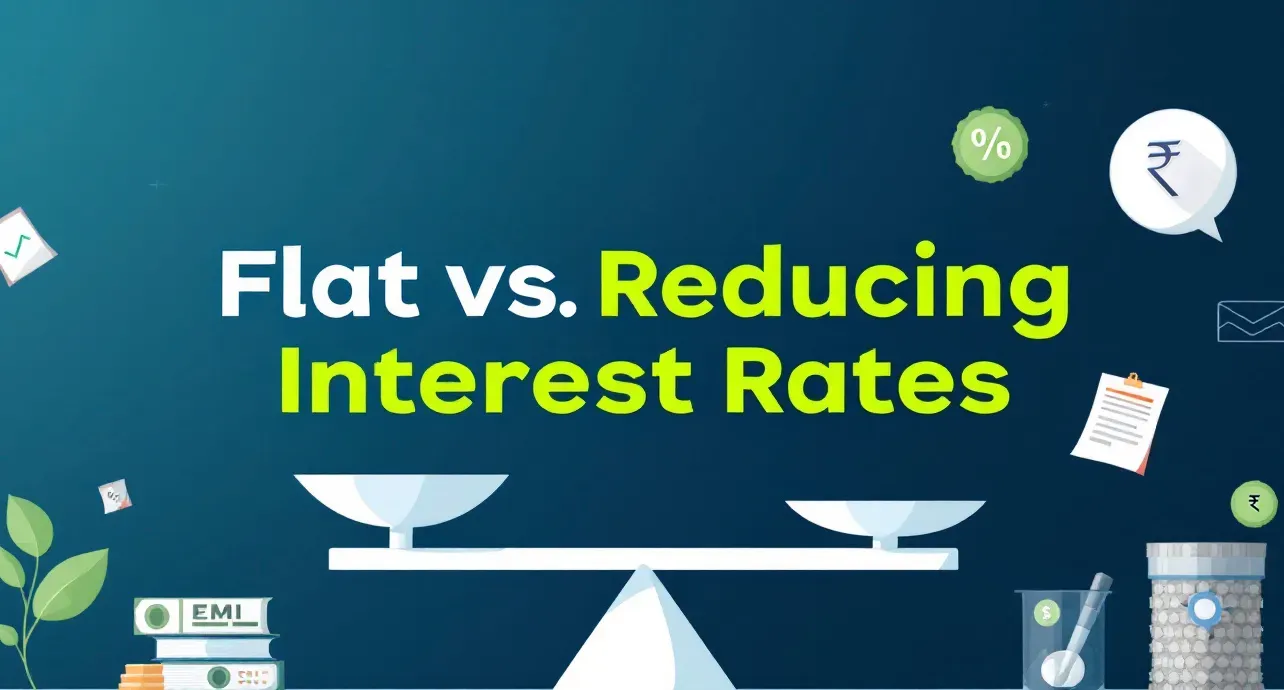

How to Apply for Business Loan, and What About Business Loan Interest Rates?

Before you apply for business loan, it will do good to follow these key points as it will help you present a strong case to lenders and increase your chances of securing a business loan with favorable terms.

1. Assess Your Financial Needs:

In the case of taking a personal loan for a business, it is important to consult on matters pertaining your business needs and establish the exact amount to borrow. It will assist you in preventing borrowing over the limit and ensure that you will be in a position to make the payments on time. You should ponder about the uses that you have in mind to get the loan especially because the institution will expect a return on investment on your behalf.

2. Check Your Credit Score:

The credit score is an important determinant when apply for business loan. Banks and other lending institutions use it to evaluate your ability in repaying the loan hence setting the business loan interest rate. A higher credit score allows one to get a lower rate of interest meaning that in the long run, one will be able to save money. To be more precise, get a recent copy of your credit report, go through it and correct all inaccuracies before applying for a loan. In addition, if the desired credit rating is lower, it is advisable to work to raise it, paying outstanding balances on credit cards or other loans.

3. Research Lenders:

Just like every other loan, there is variation in the terms and interest rates to be offered to the client by the personal loan providers. This is the reason that a potential borrower should make some efforts and reveal the differences between banks, credit unions, and other online lenders. Select those that give the best business loan interest rates, liberal repayment packages, and small hidden costs. Further, you can also check for any reviews or ‘about us’ page in the websites to understand the quality of the lender and their customers’ treatment.

4. Gather Necessary Documentation:

While going for small business loans, personal loans are comparatively easier to be availed; but as an applicant you might be required to present some documents. Commonly required documents include Adhaar card and PAN card. The exact plan which might be prepared according to the type of business depending on whether it is a new business, an existing, and so on. Recording and procurement of such documents would reduce the time taken to complete the application process and portray seriousness by the borrower.

How to Get a Personal Loan for Self-Employed?

For salaried and self-employed individuals, it is necessary that they review the qualifying requirements before they apply for business loan with low interest rates. While qualifying for small business loans, the following are important things to keep in mind:

Credit Score: Your eligibility for an immediate online personal loan is mostly dependent on your credit score, often known as your CIBIL score. Having a better credit score makes it more likely that your application will be accepted. While many lenders have minimal credit score criteria, getting a personal loan is usually regarded possible if your score is 700 or above.

Revenue and Additional Earnings: Lenders usually check for a steady stream of income from self-employed borrowers to make sure you can pay back the loan.

Age and Residency: In order to be eligible for a personal loan for self employed, you must typically be a legal adult in your nation. Additionally, being a citizen or permanent resident may be required by lenders.

Credit History: Your credit history, including past loans, total amounts borrowed, and repayment patterns, will be examined by lenders. The approval of your loan application may be influenced by any one of these indicators. To have a better understanding, check your eligibility for a personal loan using one of the many online calculators available.

Here’s How You Can Apply for Business Loan at Viva:

The documentation needed to obtain a personal loan for self-employed individuals is rather minimal. The lender could request basic identity documents, such as your PAN and Adhaar cards, to verify your details.

You can apply for a business loan for self-employment in a few easy steps by downloading the VIVA Money App from the iOS App Store or Google Play Store.

What is the duration required for the approval of an instantaneous personal loan for self-employed individuals?

It won't take more than fifteen minutes to apply for an instant personal loan based on your details. This is a very quick, simple, and uncomplicated process when using the VIVA Money App. Once all necessary information is supplied, the application is submitted, and the money is deposited into your account instantly.

Managing Your Loan

After being qualified for the personal loan for business, the most crucial aspect is proper handling of the cash. These are some tips that may be useful to you:

Make Timely Repayments: The reimbursement of the loans should also be made in relation to the due dates so as to avoid extra expenses and other risks that are pegged on low credit score.

Use the Funds Wisely: Ensure that you employ the liquefied loan in the manner as agreed in order to fulfil the intended goal of the enterprise. Regarding the factors of spending the money, do not make such money spent in other more personal expenses, which are in no way related to the operation of the business.

Monitor Your Financial Situation: Some examples are the ability to control the former through preparing the business’s accounts to know whether or not the business is in a position to make the monthly repayment or not as well as the changes that might be needed.

Conclusion:

As now you know how to get a personal loan to cater for business needs is quite useful for the growth and running of the business. When you comprehend the way, it is done and take time to prepare, your chances of being approved and the terms given are higher. Make sure you look at all your options available, and then arrive at the decision that is right for your business. Regardless of whether you own a one-person business or manage a small enterprise, a low interest business loan is a solution to help you obtain the funds for your business goals. When managed and approached correctly, a person’s personal line of credit is one of the best ways to expand a business towards the horizon of success. Thus, personal loans for your business entails identifying the need, checking the credit score, researching the lenders, preparing documents, applying for the loan, and comparing the offer details. Following the steps and given the list of options for financing, one can select the best option that would be successfully implemented in the further development of your business.