In today's busy world, having financial flexibility is not a luxury but a need. In the event of any unforeseen situations, having easy and quick access to money can help you take advantage of every opportunity. But you might be wondering which is the suitable option between a personal loan vs a line of credit in such scenarios.

This article will assist you in analysing the benefits of personal loans and credit lines and determining which would be the best option for you. However, both offer important benefits the best choice is determined by a person's unique needs, way of life, and financial objectives. You will eventually acquire the knowledge necessary to decide how to apply for an interest-free loan and how easy-to-use software may facilitate the process with a simple application.

To answer this question - personal loan vs. line of credit, which one to select? We have to understand what is a line of credit and what is a personal loan. Let's jump.

What is a line of credit?

A line of credit is a type of loan that allows a borrower to access a specific amount of money up to a certain limit. The borrower can utilize the funds for any purpose and repay them at their convenience. The borrower just pays interest on the amount borrowed and can borrow again after repaying the loan.

What are the Key Benefits of a Credit Line or a Line of Credit?

You must be wondering what are the benefits of credit lines. Well, let me break it down for you. It is specially designed for flexibility and adaptability. Here’s how it can work to your advantage:

Grace Period for Interest-Free Borrowing: Some loan apps offer a grace period during which you will not be charged any interest to repay the money you borrow. Viva Money, for example, has up to a 51-day grace period, allowing consumers to settle their balance interest-free if they pay within that timeframe. This function can be very useful for short-term loans.

Flexibility in Usage: The main benefit of a credit line is that it allows you to access cash as needed, in contrast to personal loans that offer a lump sum amount. It is sufficient to cover emergency expenses because you can withdraw the amount whenever you require.

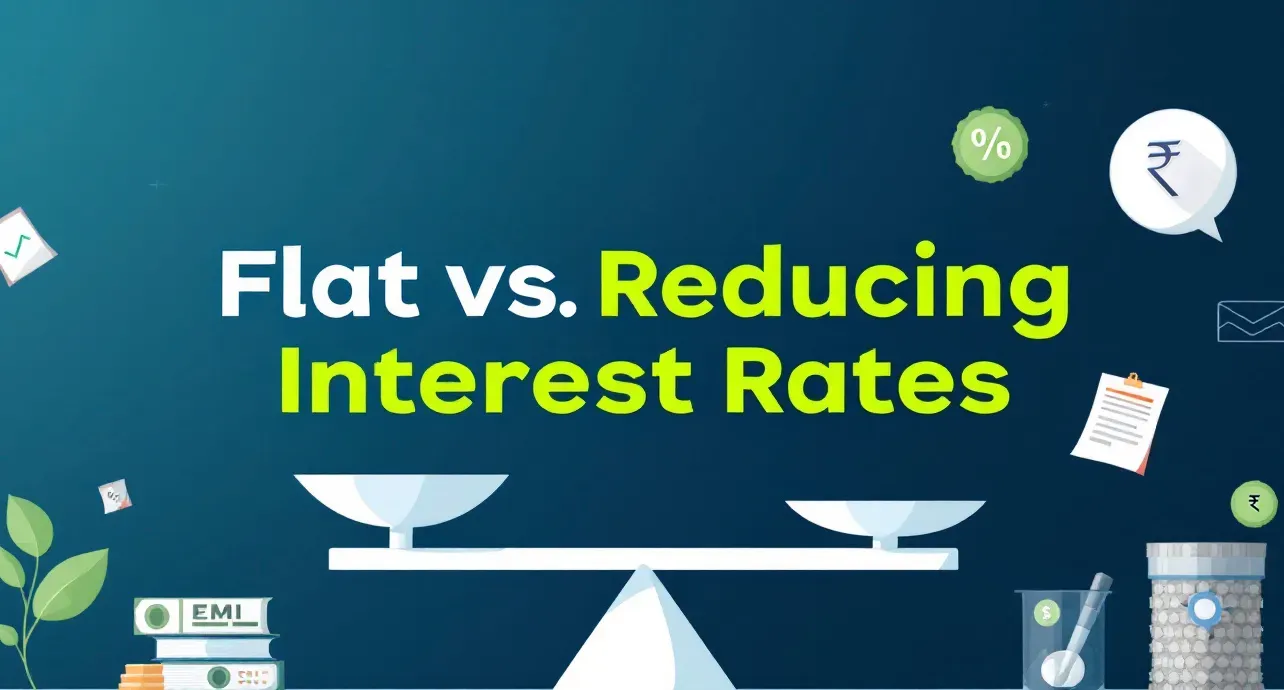

Interest Only on Borrowed Amount: The fact that interest is only charged on the amount borrowed, not the whole borrowing limit, makes it the most significant advantage. For example, if you have a ₹2,00,000 line of credit but only use ₹50,000, your interest will be charged only on ₹50,000. Over time, this technique can result in significant savings.

Revolving Credit with Easy Access of Instant Loan App: As you pay off debt, the funds become available for future use, similar to a credit card. This continuing investment is particularly useful for managing long-term or recurring expenses. The instant loan app makes it simple to receive your loan amount with a few clicks whenever you need it.

Enhanced Financial Control: A revolving line of credit can be a financial safety net, allowing you to cover unforeseen needs without having to reapply every time. Paying and managing flexible payments allows you to manage cash flow based on your budget, which can be especially valuable for people with variable monthly expenses.

What is a personal loan?

It is a form of loan that provides a lump sum amount for personal use. A personal loan is an installment loan with monthly payments and a fixed interest rate. You can use that amount according to your needs, including debt reduction, home renovations, and medical expenses.

What are the benefits of personal loans?

Now let's see the benefits of personal loans. Well, personal loans can be reliable solutions for those looking for a fixed timeline. Presenting the in-depth analysis:

Fixed Repayment Structure: Personal loan repayment options are simple, with fixed monthly installments at a fixed period. This technique can help you construct a budget more quickly because you'll know exactly how much you need to set aside each month to cover the debt.

Interest rate of a personal loan: Personal loans have a fixed interest rate with a fixed repayment date, which safeguards them against market loan interest increments. This strategy expands accuracy and makes it simple to decide the total credit sum all along.

Higher Borrowing Limits for Major Purchases: Personal loans typically have bigger credit limits than a line of credit, making them appropriate for essential financial commitments such as home renovation, marriage, etc, or consolidating a high-interest loan.

Personal Loan vs. Line of Credit - which one should you choose?

In this battle of personal loan vs. line of credit, we got some key points to highlights. A personal loan can be a better option to manage bigger expenses with fixed repayment terms. But it comes with cons like - Long approval time, and documentation. Where Credit Lines can be a better option for people who are looking for quick funds, or people who need a partner to manage their daily expenses, as they give you the flexibility to withdraw money anytime, anywhere, as needed. Applications like Viva Money give you simple access to their credit line with a grace period of up to 51 days for an interest-free loan. So what are you waiting for? Download the Viva Money app now and say goodbye to financial worries.