Have you ever felt that financial limitations are stopping you from taking essential steps in your life? Well, you are not alone, my friend. Everyone has a dream of living a lavish life, and it is evident that different people have different priorities. Some want to establish their own businesses, some want top-notch education, and some people want to buy their dream homes.

In such situations, a loan can be an ideal way to bridge the gap between your aspirations and reality. But which loan should you choose? Confusing right? In this blog, we will understand the different types of loans in India. Let's dive in.

What is a Loan?

A loan is a way of accumulating debt by a person or other entity. A lender, which is typically an organization, financial institution, or the government, disburses a certain amount of money to a borrower in exchange for terms that the borrower agrees to abide by, which include any finance charges, interest, repayment date, and other specified conditions.

Different Types of Loans in India

Loans in India are classified into two parts: secured and unsecured loans. These loans are ideal for major financial goals like financing a business, buying a home, or managing any financial crunches.

Secured Loan

Secured loans refer to types of loans in India that require one to pledge an asset as a guarantee to the lender. In case you are unable to repay the fund, lenders can recoup their losses using the collateral. Because of this, lender provide secured loans at a lower interest rate as collateral lessens their risk. Under this type of bank loan, the bank has no further right to claim anything from the borrower apart from the collateral they provided.

Types of Secured Loans

Now that you understand the secured loan, let’s explore the most common types of secured loans in India and how they work:

1. Home Loan

Planning to buy a house? A home loan helps you afford the property by financing most of the cost. The house you buy acts as the security for the loan.

2. Car Loan

A car loan helps you purchase a vehicle by paying in EMIs instead of a lump sum. The car itself serves as the collateral.

3. Loan Against Property (LAP)

Own a residential or commercial property? You can use it to get funds through a loan against property. The property remains in your name, but it’s kept as security until the loan is repaid in full.

4. Gold Loan

Gold isn’t just for wearing—it can help you in emergencies too. In a gold loan, you pledge your gold jewellery or coins to a lender and get a loan amount in return. Once you repay, your gold is returned safely.

5. Loan Against Fixed Deposit (FD)

If you have a fixed deposit and don’t want to break it early, you can take a loan against your FD. This allows you to borrow a percentage of your FD amount while it continues to earn interest.

6. Loan Against Securities

Have investments like shares, mutual funds, or insurance policies? You can use them as collateral to get a loan without selling them. It’s a great option for investors who want liquidity without disturbing their portfolio.

Eligibility criteria for a secured loan

The eligibility criteria for a secured loan are as follows:

- Applicants must be at least 18 years of age.

- The individual must have Indian nationality.

- Ensure you have all valid identification documents.

- Make sure you have a stable annual income of minimum 3 lakhs.

- The individual must provide bank statements to verify their income.

- Maintain a strong credit score and a good credit history to improve approval chances.

- Applicants must have assets that they can provide as a guarantee to take out any loans.

Unsecured Loan

Unsecured loans are a type of loan in India in which borrowers don't have to provide any collateral as a guarantee. This means that borrowers do not need to have any assets, such as property or vehicles, to secure the loan. Instead, approval is based on the borrower's creditworthiness, which includes credit history and other financial indicators.

Types of Secured Loans

Now that you understand the unsecured loan, let’s explore the most common types of unsecured loans in India and how they work:

Personal loans

Among the most common list of unsecured loan categories, personal loans are adaptable and can be utilized for various purposes, like education loans, home loans, or clinical expenses. These loans are given by banks that base their choices on your paychecks, income tax returns, and credit score.

Credit Card

Another type of unsecured loan is a credit card, you can take out a loan up to a particular amount and pay it back over time. Depending on the kind of loan, interest rates might vary and even be rather high.

Line of Credit

A line of credit is similar to a credit card but typically offers a larger borrowing limit. It is a simple method and is frequently used for payment. You only have to pay interest on the loan when you take it out as needed. If you are looking for a hassle-free solution, then Viva Money is the right place for you. It offers a revolving line of credit with zero paperwork from 5,000 up to 2,00,000 at zero interest for up to 51 days of the grace period. It has become the top choice in the list of unsecured loans due to its easy accessibility.

Short-term Loans

Another type of unsecured loan is a short-term loan, which is also known as a payday loan, intended to be paid back on your subsequent paycheck. Despite their convenience, they should be utilized carefully because they frequently have significant fees and interest.

Eligibility criteria for an unsecured loan

- The eligibility criteria for an unsecured loan are as follows:

- Applicants must be between the ages of 21- 64 years.

- Maintain a strong credit score and a good credit history to improve approval chances.

- The individual must have a stable income of ₹15,000 and family income of ₹25,000

- Ensure you have all valid identification documents.

Factors to Consider Before Applying for a Loan

Applying for a loan isn’t just about getting money quickly—it’s a commitment that can impact your finances for years. Whether you’re applying for a personal loan, a home loan, or any other type, here are some key things to think about before you hit “Apply Now.”

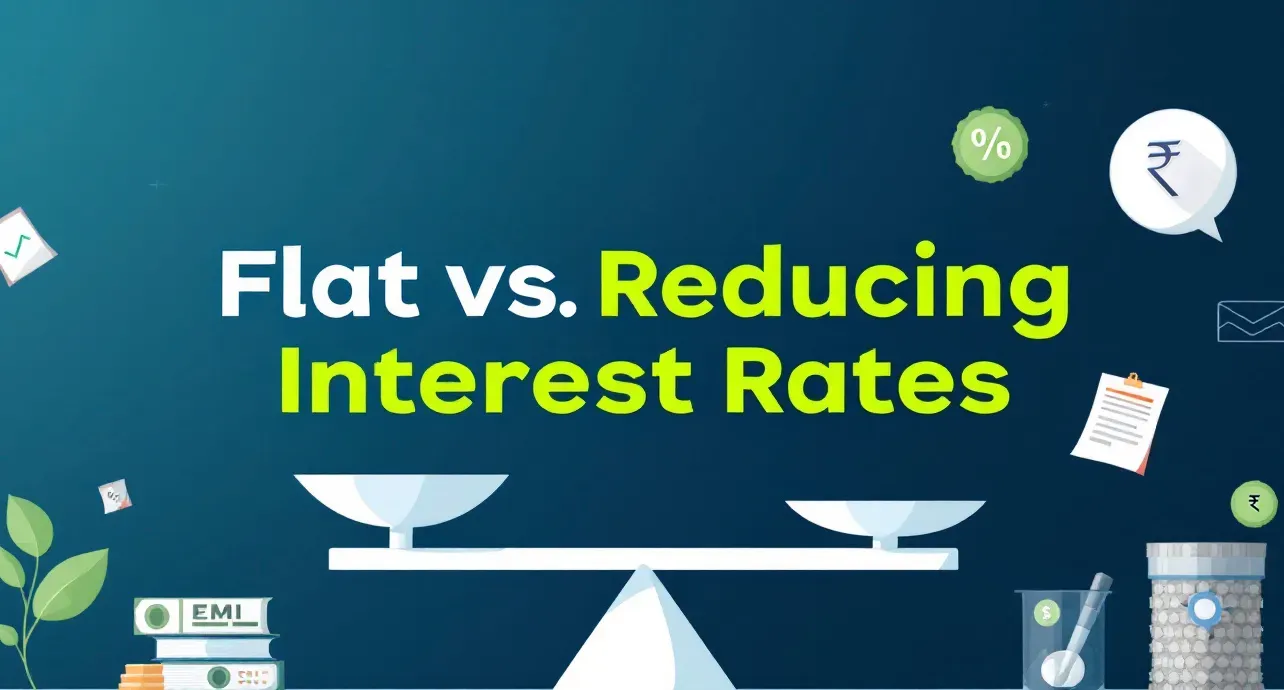

1. Always compare interest Rate from different lenders as it will directly affect your total repayment amount.

2. Check your repayment Tenure as longer tenure may lower your monthly EMI, but it increases the overall interest paid and a shorter tenure means higher EMIs but lower total interest.

3. Before applying, calculate how much EMI you can comfortably pay each month without affecting your daily expenses and other financial commitments.

4. Always check what are the additional Charges are coming with your loan. Review the loan documents carefully and ask your lender for a full breakdown of any additional costs.

5. Your credit score plays a major role in loan approval and the interest rate offered. A higher credit score increases your chances of getting better loan terms.

6. Make sure you have all the necessary documents ready—ID proof, income proof, address proof, and any other documents the lender may require.

7. Understand the different types of loans in India before applying. Then apply for a loan that resonates with your needs and financial circumstances.

8. Choose a lender with a reliable background. Read customer reviews, check for complaints, and make sure the lender is registered and follows proper guidelines.

Conclusion

Loans can open doors to your dreams—but only if chosen wisely. By understanding the different types of loans in India and knowing what to look for before applying, you can make smarter financial decisions. Always borrow responsibly and choose the loan that fits your needs and financial situation.

Platforms such as Viva Money are changing the loan experience in this expanding market. Viva Money guarantees a seamless, quick, and easy financial journey with its cutting-edge digital lending platform. Therefore, remembering the right loan could be the secret to turning your goals into reality.