Need funds for farming? Explore agriculture loans—low rates, easy terms & grow your farm with ease!

Want to boost loan approval chances? Understand FOIR, its calculation, and ways to manage it effectively!

Thinking of closing your loan early? Learn how loan foreclosure works, its benefits, charges, and key insights!

Need urgent funds? Explore the best small credit loan apps in India for quick and hassle-free loans!

Need quick cash? Spot loans offer instant funds with minimal paperwork. Know the pros & cons before applying!

Don't let myths misguide your home loan decisions! Uncover the facts and make informed choices today.

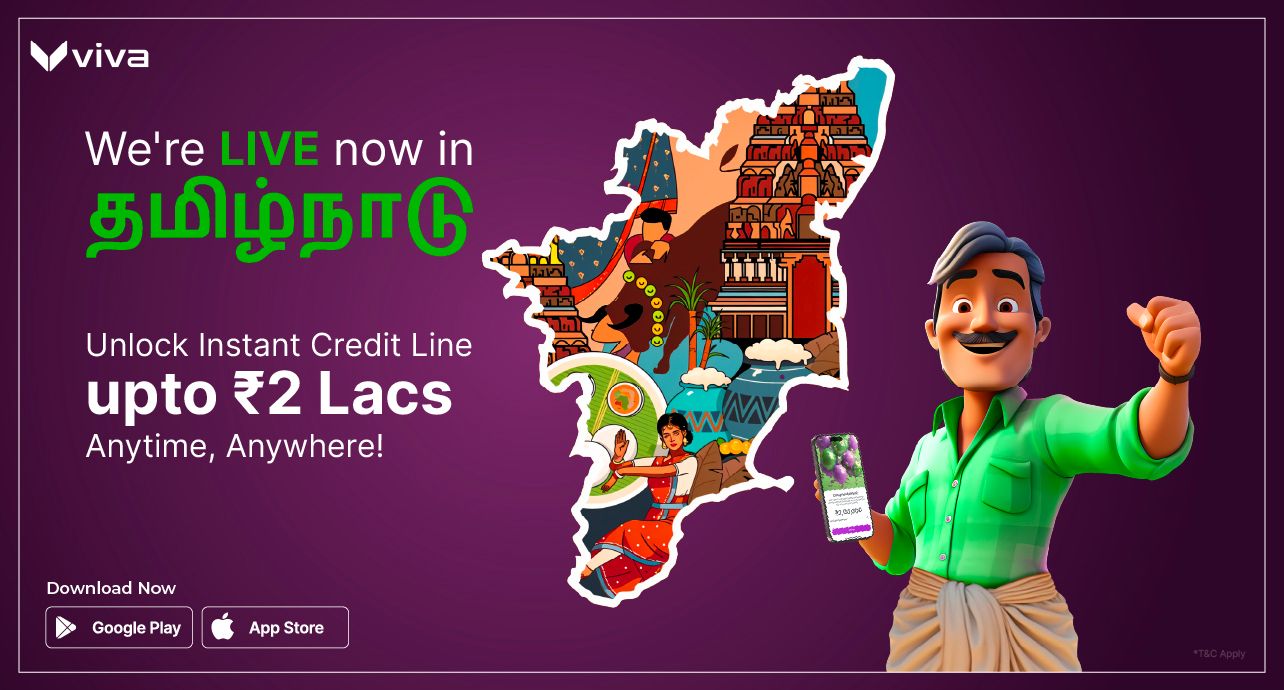

Viva Money expands to Tamil Nadu! Get instant loans with zero paperwork, no hidden charges & flexible repayment. Financial freedom is now just a tap away!

Planning to fund your studies? Discover everything about education loans in India—types, benefits, eligibility, and the application process!

Flex loans: Instant funds when you need them, but at what cost? Know the facts before you borrow!

Start budgeting today! Follow these simple steps to gain control over your finances and reach your goals.

Confused about secured vs. unsecured loans? Learn their key differences, benefits, and which suits your needs.

Your FD can do more! Secure a loan against it and meet urgent needs without losing your savings

Need a loan without giving up your asset? Discover how hypothecation lets you secure funds while owning it!

Need a new gadget or appliance? Learn how consumer durable loans make big purchases easy and affordable!

Money isn't just a goal—it's a tool! Discover how Gen Z and Millennials are mastering financial independence with money management apps and instant personal loans.

Make smarter investment decisions! Discover how capital budgeting helps businesses allocate resources wisely, manage risks, and maximize profits for long-term success.

Flat vs. Reducing Interest Rates: Which One Saves You More? Uncover the Secret to Smarter Borrowing!

Short on funds? Learn how an overdraft facility can be your financial safety net!

Need funds for farming? Explore agriculture loans—low rates, easy terms & grow your farm with ease!

Need quick funds in Tamil Nadu? Get up to ₹2 Lacs instantly with Viva Money! 0% interest for up to 51 days, fast approvals & no collateral—apply now!

Struggling to manage business finances? Learn the key objectives of financial management and how they drive growth, stability, and success!

Need Extra Cash? Discover How a Top-Up Loan Can Help Without the Hassle of a New Loan!

Looking for an education loan in 2025? Learn how interest rates impact your repayment and find the best loan option for your financial goals with this detailed guide!

Ever Wondered How Banks Approve Big Loans Faster? The Co-Lending Mystery Unveiled!

Confused about demand drafts? Learn how they work, their benefits, charges, and why they’re a secure payment method!

NBFC vs Bank: Which one suits your needs? Learn the key differences & make a smart financial choice!

Starting your own business? Discover how personal loans for the self-employed can help you grow!

Quick cash in minutes—no credit checks! But is a payday loan in India really worth it? Know the hidden truths!

Confused about home loans? Explore different types of home loans in India & choose the right one for you!

Planning for a car loan? Learn how interest rates impact your EMI & how to get the best deal in 2025!

Looking to buy land? Get a plot loan with low-interest rates, flexible repayment & quick approval. Turn your dream into reality today!

Looking for a business loan? Learn how to secure the best interest rates & calculate EMIs before applying!

Need urgent funds? Discover how short-term loans can help you tackle unexpected expenses quickly and hassle-free!

Own your dream motorcycle now, pay later! Discover how a two-wheeler loan makes ownership easy and affordable.

Plan your dream wedding without financial stress! Learn how wedding loans can cover your big day expenses.

Take charge of your finances! Learn how cash budgets help you track income and manage expenses smartly.

Need funds in Chennai? Get up to ₹2 Lacs instantly with Viva Money! Zero paperwork, 0% interest for up to 51 days & quick approvals—apply now!

Worried about medical expenses? Discover how a medical loan can ease the financial burden!

Turn your dreams into reality with the right loan! Discover the various types of loans in India, from personal and home loans to education and gold loans.

Still believe budgeting kills fun? Think again! Uncover the surprising truths behind budgeting myths!

What is an unsecured loan? Discover the types of unsecured loans and how they can help you meet your financial needs without collateral.

Master budgeting with ease! Discover how line-item budgeting simplifies finances for everyone.

Fixed vs. Flexible Budgets: Discover the key differences and choose the best fit for your financial goals!

Need a loan without income proof? It's possible! Discover how to simplify personal loans with minimal documentation, instant approvals, and hassle-free processes.

A term loan can fuel your growth! Discover its meaning, types, & features to make an informed decision.

What is budget? Explore budgeting types, learn effective management, and take control of your finances!

Plan for a financially empowered 2025! Learn how a smart budget can turn resolutions into reality!

Confused about credit cards? Find out which credit card suits your financial journey best!

Confused between a personal loan or a line of credit? Explore the benefits of each to find your perfect match!

Looking for a quick loan? Skip the queues and paperwork with an easy instant loan process!

Discover how personal loan apps are revolutionizing finances in 2025! Instant, hassle-free, and empowering.

Need funds for your business? Discover how personal loans can fuel your growth fast and hassle-free!

Viva Money is now live in Maharashtra. Get quick loans without any hassle in just 15 minutes!

Need quick cash? Discover the simplicity and speed of RBI-approved loan apps!

No delays, no paperwork! Get an NBFC personal loan instantly and handle emergencies with ease.

Financial freedom made simple: Explore the benefits of a line of credit and borrow smarter today!

Want a better credit score? Learn how to check, improve, and maintain your CIBIL score easily!

Wondering if you qualify for a personal loan? Check out these simple eligibility tips!

Discover the importance of eNACH for seamless recurring payments in digital services.

Discover the best personal loan in Gujarat with quick approval and 0% interest for up to 51 days.

Need funds fast? Discover how salaried professionals can get personal loans with ease and speed!

Master credit card usage with smart tips for managing debt, boosting your credit score, and more.

Living the Bangalore dream? Manage rising expenses effortlessly with Viva Money.

Avoid these common mistakes and make a smart, stress-free borrowing decision!

Discover how KYC strengthens trust, prevents fraud, and shapes the future of financial security!

Struggling with unexpected expenses? Discover how a Line of Credit can give you financial freedom!

Looking for a low-interest personal loan? Discover easy tips to secure the best rates and save more!

Discover how to easily check CIBIL score online and unlock benefits like better loan terms and faster approvals!

Personal loan, credit card, or line of credit? Learn the key differences to make smarter financial choices!

Learn how to use an EMI calculator for stress-free personal loan management.

<p>Low credit score? Discover how urgent loans for CIBIL defaulters can offer a second chance.</p>

<p><style type="text/css"></style><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Think saving is hard? Discover the simple money habit that grows your wealth without effort.</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Hit 750 and beyond—master the habits that transform your CIBIL score and open more financial doors.</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Can banks really control inflation? Discover the secret tool they use to steady the economy.</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Flex loans: Instant funds when you need them, but at what cost? Know the facts before you borrow!</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Can banks really control inflation? Discover the secret tool they use to steady the economy.</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Confused between Fixed and Recurring Deposits? Learn how these two popular savings options differ and which one suits your financial goals and saving habits</span></span></p>

<p><style type="text/css"></style><span style="font-family:Arial;font-size:10pt;"><span style="font-style:normal;" data-sheets-root="1">Quick access to cash without affecting your savings—uncover the benefits of a PPF loan.</span></span></p>